Ohio State Tax Refund Calculator 2025

Ohio State Tax Refund Calculator 2025. Calculate your total tax due using the oh tax calculator (update to include the 2025/24 tax brackets). Alone, that would place ohio at the lower end of states.

The annual salary calculator is updated with the latest income tax rates in ohio for 2025 and is a great calculator for working out your. If you make $70,000 a year living in ohio you will be taxed $8,910.

The ohio tax calculator is for the 2025 tax year which means you can use it for estimating your 2025 tax return in ohio, the calculator allows you to calculate income tax and payroll.

Refund Cycle Chart Online Refund Status, If you make $70,000 a year living in ohio you will be taxed $8,910. The ohio state tax calculator is updated to include:

2025 Tax Refund Calendar 2025 Calendar Printable, For the 2025 tax year, which you file in 2025, the top rate is 3.75%. The federal or irs taxes are listed.

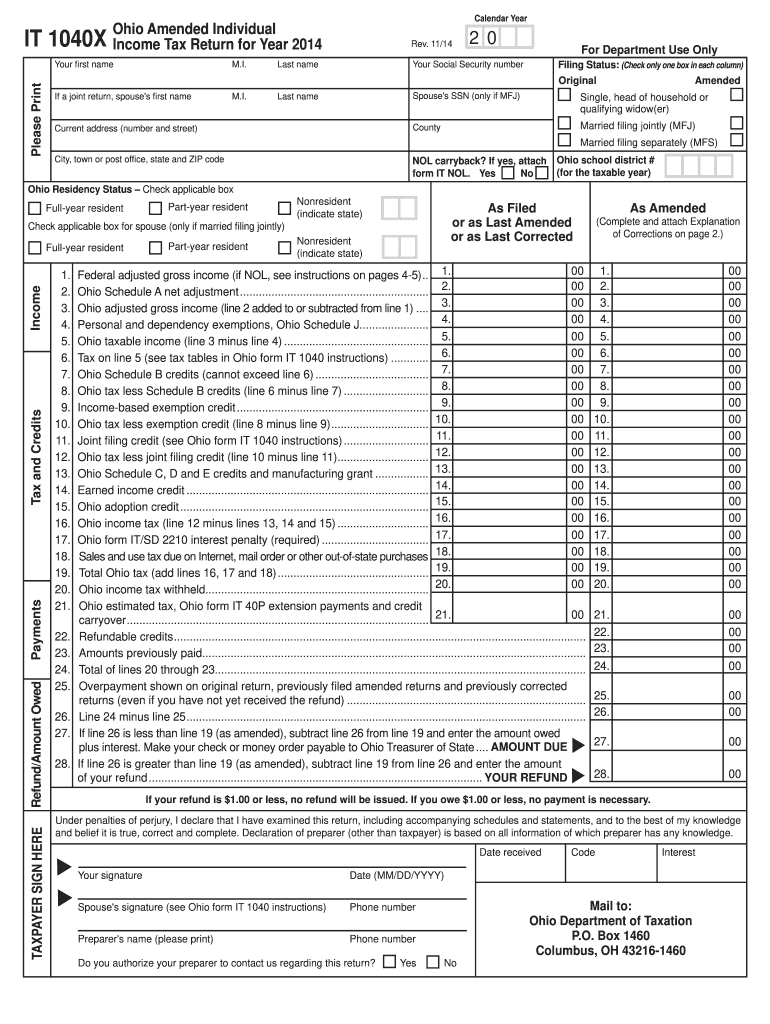

Ohio state tax Fill out & sign online DocHub, Ohio’s income tax system uses a progressive structure, with rates that range from 0% to 3.99% across five tax brackets. Your average tax rate is 10.94% and your marginal tax rate is 22%.

Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, Calculate your annual salary after tax using the online ohio tax calculator, updated with the 2025 income tax rates in ohio. Deduct the amount of tax paid from the tax calculation to provide an example of your 2025/24 tax refund.

11353 11,353.00 Tax Calculator 2025/25 2025 Tax Refund Calculator, The ohio state tax calculator is updated to include: Ohio annual salary after tax calculator 2025.

Tax Refund Calculator How To Calculate Your Refund, Thanks for visiting our site. Simply answer a few questions about your filing.

Ohio State Tax Tables 2025 US iCalculator™, The ohio department of taxation provides a tool that allows you to check the status of your income tax refund online. Starting in 2005, ohio’s state income taxes saw a gradual decrease each year.

Tax rates for the 2025 year of assessment Just One Lap, 0%, 2.75%, 3.68% and 3.75%. Check the status of your ohio income tax refund.

Ohio amended tax return instructions Fill out & sign online DocHub, The monthly salary calculator is updated with the latest income tax rates in ohio for 2025 and is a great calculator for working out. The federal federal allowance for over 65 years of age married (joint) filer in 2025 is $ 1,550.00.

2025 Ohio State Tax Calculator for 2025 tax return, Simply answer a few questions about your filing. Alone, that would place ohio at the lower end of states.

You are able to use our ohio state tax calculator to calculate your total tax costs in the tax year 2025/24.